Executive Summary

To Bank Depositors in Lebanon

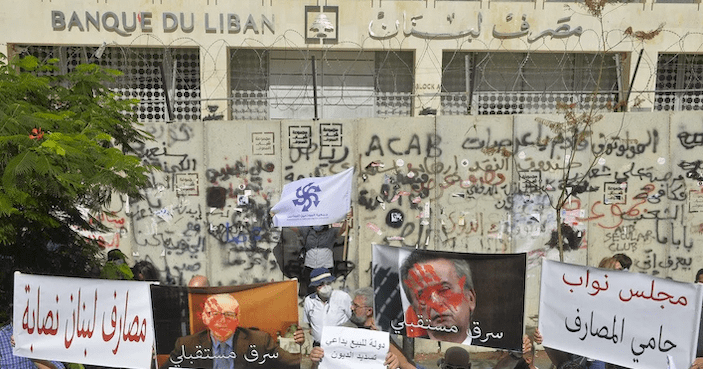

(Confronting Banks, Banque du Liban, and Government)

Bank depositors in Lebanon continue to bear practically alone the impact of the banking collapse. To regain their rights and effectively confront banks, BDL and Government, they need first to understand what happened, determine degrees of responsibility, then act.

Two collapses have occurred in Lebanon, not one, a banking collapse and a Lira collapse, with different natures, causes and impact. Unlike today, the similar Lira collapse in the mid-1980s happened in the context of strong and very $-liquid banks that continued to normally operate.

The cause of and responsibility for the current banking collapse is BDL’s mismanagement through its “financial engineering” that led to negative net reserves, alongside the banks’ mismanagement that put around 80% of their $-deposit resources at BDL, thus taking their $ liquidity to a very low 7% for the sake of extraordinary but short-term profits. Independently of the banking collapse, the Lira’s collapse is the result of a lax fiscal policy by Government and widespread corruption, making Lebanon live for years beyond its means in the context of a fixed exchange rate and an unprecedented balance of payments in deficit since 2011.

An Appendix explains the sources and uses of $ available to BDL during 2015-19. At least $33 billion outflow from BDL are unaccounted for. The likely explanation is that most of these funds correspond to bank profits, mainly in Liras, and other Lira assets that have been exchanged for $ from BDL through market operations. It is also quite likely that these profits have been transferred in $ outside Lebanon, not in favor of the banking institutions but in favor of their main shareholders.

A course of action is proposed to bank depositors.

- Confront banks, BDL and Government with the explanation of and responsibility for what happened, a responsibility to be mirrored in an eventual distribution of losses.

- Propose that banks should re-capitalize or be subjected to bankruptcy proceedings, as is normal in any country, which would put a stop to continuing bank losses that are eventually paid by depositors, and invite foreign banks to operate in Lebanon, which would lay the basis for a normally operating banking system.

iii) Ask BDL to justify its ad hoc circulars that impose harsh “haircuts” and ceilings particularly on Lira withdrawals from all deposits, leading to a sharp and continuous fall in money supply by more than 95% relative to end 2019, compared to a fall of about two thirds in current GDP . Withdrawal ceilings should be relaxed, and haircuts much reduced, since this BDL policy puts all the burden of adjustment only on depositors, and unnecessarily reduces effective demand, thus straining economic activity and growth.

READ THE FULL REPORT IN PDF:

Konrad lebanese bankers final one