Ladies and gentlemen, distinguished guests,

I would like to start by expressing a word of congratulation and gratitude to Minister Amer Bsat for having conceived and launched this conference despite many challenges not least of them our natural Lebanese skepticism about anything that is good or that works. I would like to also thanks all those who contributed to organizing this conference.

For the distinguished audience, we thank you for joining us. Your presence today reflects something important—your willingness to listen, engage, and evaluate Lebanon based on facts, discipline, and direction. This is exactly the standard to which we are holding ourselves.

My message is straightforward: Lebanon is working on rebuilding its financial architecture on principles that successful economies share—monetary stability, institutional clarity, and capital-market dynamism. These are the foundations on which investor confidence is built.

I. Re-Centering the Mandate of the Central Bank

Over the past years, the role of the central bank became blurred, and I am being politically correct. Not one of my traits.

In moments of crisis, institutions sometimes overreach—and in Lebanon, the boundaries between monetary, fiscal, and political responsibilities became dangerously thin.

Our task today is to restore clarity.

A central bank must focus on three core duties:

This institutional reset is essential. Without it, no reform can take root. So, as a reminder to the political authority, the central bank is the bank of the State not the banker of the State. Its role does not include the curing of chronic deficits by concocting so-called deposit gathering initiatives -that we called financial engineering- as a palliative to fiscal discipline. Another reminder to commercial banks, the central bank is your regulator not your broker or financial enabler and it is a lender of last resort, not the provider of richly rewarding instruments so you could buy a resort.

II. Transitioning Beyond a Sovereign-Dominated System

For too long, Lebanon’s financial system acted as the primary financier of the State.

Sovereign exposure in the banking sector reached levels that were not only unsustainable but structurally unhealthy.

A system in which the State absorbs most domestic savings cannot deliver growth or innovation. It can only reproduce fragility.

We are working towards a deliberate transition:

This transition is not cosmetic. It is foundational to the new financial architecture. Even the skeptics would agree: “the Party is Over – Back to banking as it was designed to be”. The productive economy -not the rentier type- needs a well-capitalized, well-governed and a risk-adjusted banking sector whose funding capabilities must be complemented by private capital raised through placements and public offerings and listed on a regulated stock exchange.

III. Three Pillars of the New Financial Framework

1. Free and Transparent Flow of Capital

Investors must know where capital can move and on what terms.

We are establishing a framework where transparency, not opacity, governs financial flows—ensuring trust and predictability. Transparent money flows are the oxygen of capital markets; without them, markets become vulnerable conduits for misuse, manipulation, and in some instances, illicit finance.

2. Deep, Efficient Capital Markets

Economic vitality requires instruments beyond deposits and sovereign paper.

We intend to cultivate:

3. Exchange-Rate Stability and Credible Monetary Policy

A stable currency is not merely a policy target—it is a signal of institutional reliability.

Our aim is to anchor expectations, reduce volatility, and reaffirm Lebanon’s monetary credibility.

Monetary stability is the foundation on which healthy capital markets, and long-term investor confidence are built. Without a stable currency, not a fixed one and not a pegged one, prices lose meaning, contracts lose reliability, and investment horizons collapse into short-term speculation

Achieving it requires a coherent and disciplined framework—one that countries have pursued through several tested and proven tools. A free exchange rate reflects real market forces and absorbs external shocks. A managed float tempers excessive volatility while preserving flexibility. More disicplined tools include a currency board which provides near-automatic stability when confidence is fragile and institutions require reinforcement.

Whatever the choice of regime, the principle remains constant: monetary stability is not a luxury but a precondition for deep capital markets, resilient banking systems, and the return of serious, long-term investment.

These three pillars reinforce each other, forming the strategic core of our work.

IV. A Realistic and Deliverable Vision

We should not be offering a quick fix. We are building the pillars of our financial architecture starting with the Banking Restructuring Framework which we have developed, in close coordination with the Government and with the key Ministries of Finance and Economy.

This Framework is the building block on which the Financial Stabilization and Deposits’ Repayment Act will be set and completed. We are aiming, with the Government, to have such Act submitted to the full Cabinet in a brief delay -maybe few weeks- and then to the Parliamentthereafter, despite the usual apprehensions, negative biases and mistrust that many engage intoonline and offline, as a national pastime.

This Act will determine the obligations to be repaid and their allocation among the State, the central bank, and commercial banks; set the hierarchy of claims based on an Asset Quality Review for each banking institution; define the prudential capital adequacy requirements applicable to all banks regardless of their post-crisis capital status; and specify the deposit segments and the mix of cash and securities (to be listed) through which depositors will be repaid over time.

The restructuring of banks in Lebanon will not be painless and will take some time, but most importantly it must be sequenced, credible, and policy driven.

Our vision is guided by four commitments:

This is how countries rebuild, and this is how our financial system will regain credibility.

V. Closing

You all know that confidence is not restored by declarations; it is restored by conduct. So, we invite you to judge our deeds not our words.

Direction matters, and today Lebanon has a clear one:

We are aligning institutions with international standards,

We are modernizing the financial environment

We are combating the dark economy and seeking our way out of the Gray List.

And we are grounding every step in transparency, accountability, and collaboration with a serious and hardworking government, and hopefully, with partners like you.

Thank you.

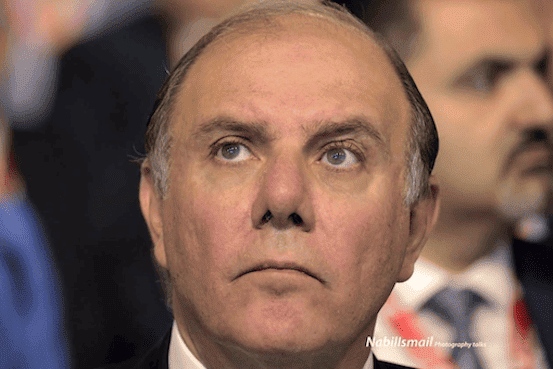

*Karim Souaid is Governor of the Central Bank of Lebanon.

صدق الله العظيم