Beirut December 23, 2025

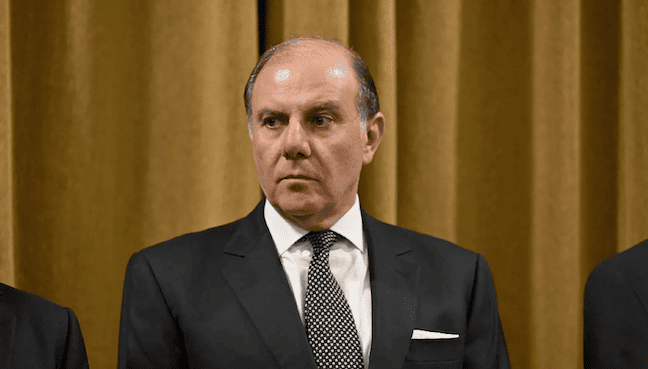

Statement by the BDL Governor

Position of the Governor of Banque du Liban on the Draft Financial Stabilization and Deposits Repayment Act (FSDR Act)

Legal Basis and Process

Pursuant to Articles 71 and 72 of the Code of Money and Credit, the Governor of Banque du Liban (“BdL”) has been formally consulted by the Government and has actively participated in the deliberations of the restricted committee mandated to prepare the draft Financial Stabilization and Deposits Repayment Act (the “FSDR Act”).

General Assessment

The Governor supports the overall architecture of the draft FSDR Act and endorses its core principles, namely:

1. the reduction of the financial deficit through the elimination of irregular claims;

2. the segmentation of deposits into clearly defined categories (small, large, and very large);

3. the repayment of deposits through a combination of cash and asset-backed securities, over time and within the limits of available liquidity; and

4. the allocation of financial responsibilities among the State, BdL, and commercial banks.

Key Tests for the Legislation

The Governor emphasizes that the soundness and sustainability of the FSDR Act must be assessed against two essential criteria:

(i) fairness and equitable allocation of financial burdens; and

(ii) realistic and enforceable implementation.

Fairness and Allocation of Responsibilities

The Governor stresses the FDSR has respected the principle of fairness. He emphaisezes that each stakeholder must bear its appropriate share of responsibility. In this respect, the draft FSDR Act requires further clarification and strengthening of the State’s commitments. As the ultimate user of the funds over many years, the State’s contribution must be expressly defined, quantifiable, legally binding, and anchored within a clear and credible timetable.

Credibility and Implementation

The repayment of deposits is a legal right, not a discretionary policy choice. However, this right must be supported by a credible repayment program. Financial credibility rests on available assets, effective liquidity, and a repayment schedule that can be honored in practice. The proposed timetable for the cash component of deposit repayments is somewhat ambitious, and if need be, may be adjusted—without impairing depositors’ rights—to ensure regular, uninterrupted, and complete payments over time.

Protection of the Banking Sector

As a matter of financial stability, the Governor expresses serious reservations—grounded in established legal principles, applicable accounting standards, and international precedents—regarding any approach that would result in the systematic depletion or elimination of banks’ equity capital prior to the removal of irregular claims from their balance sheets and the subsequent application of the hierarchy of claims.

Under the FSDR Act, commercial banks are partners in the deposit-repayment framework and constitute the core engine of credit intermediation essential to economic recovery. Any solution that systematically eradicates banks’ equity capital would therefore be detrimental to depositors, would undermine prospects for economic recovery, and would further entrench the expansion of the cash-based and informal economy.

Recommendation to Cabinet

Given the critical importance of the FSDR Act—the most consequential financial legislation since the Code of Money and Credit of 1963—the Governor recommends that the Cabinet undertake a careful, thorough, and constructive review of the draft. This review should aim to introduce the necessary enhancements and clarifications to ensure fairness, credibility, and practical enforceability before submission to Parliament.

[…] Statement by BDL Governor on the Draft Financial Stabilization and Deposits Repayment Act (FSDR Act… […]