Outline

Executive Summary

- The road to the fall of the Lira

- Causes

- Consequences

- Containing the crisis

Appendix

References

Tables

Table 1: Banque du Liban: FX Reserve Position

Table 2: Commercial Bank Asset Structure

Lebanon: Anatomy of a Currency Crisis

Executive Summary

The continuing popular uprising in Lebanon is mainly driven by economic grievances and protests against the underlying political corruption. The fixed exchange-rate regime since end 1998 has become unsustainable in view of loose and unchecked monetary and fiscal policies since then. Mounting government debt and enduring balance of payments deficits have finally resulted in the recent depreciation of the Lebanese Lira in the parallel foreign exchange (FX) market while the “official” rate is maintained.

The principal cause of the current monetary crisis is Banque du Liban’s (BDL) long-standing “financial engineering”, which consists in borrowing $-funds from local banks at unusually high margins above interest rates prevailing in international markets, resulting in high BDL $-debt and negative net reserves. The budget deficits and government debt have mostly financed current rather than capital expenditures, while swelling employment in the public sector, which also contributed to the financial deterioration.

The root cause of Lebanon’s economic hardships lies, however, in Lebanon’s loss of its sovereignty. In fact, the leader of the powerful Lebanese party Hezbollah publicly acknowledges that its ideological, political, and military existence is subservient to the Supreme Leader of Iran. No country can remain stable or prosper if its major political and military decisions are controlled by a foreign or illegal power.

The consequences are damaging throughout. With 71% of their assets as credit to the public sector, Lebanese banks’ liquidity and financial condition have become fragile, and credit to the private sector has declined, with a corresponding weakening in economic activity.

Short of regaining its sovereignty, Lebanon urgently needs the early implementation of specific reform policies to contain the worsening monetary crisis: a) the adoption of a 3-year budget, 2020-22, with a gradually declining deficit to reach close to balance in the year 2022; b) question BDL’s “financial engineering” policy towards reducing its very high interest cost; c) public sector reform starts with all public enterprises submitting and publishing their audited financial statements, which is a legal requirement.

Lebanon: Anatomy of a Currency Crisis

The ongoing popular uprising is unprecedented in Lebanon, for it has spread with unexpected vigor across religious groups, regions, and social classes. The complaints and slogans of the demonstrators clearly indicate that the driving force of the uprising springs from economic grievances: absence of job opportunities, low incomes, unemployment, poverty, and the underlying corruption of the governing class.

These grievances, in a context of enduring low economic growth and high and rising government debt, point to the plain failure of official economic policy and to serious structural problems in the Lebanese economy. Addressing these problems takes time. However, the subject of this paper is the much more pressing deteriorating financial situation, especially the monetary situation with the beginning depreciation of the Lebanese Lira, the first time since end 1998. This is a momentous development since a significant depreciation will further impoverish most Lebanese, and carries uncertain but serious social and political consequences.

This paper therefore focuses on the worsening monetary situation, and may be considered an update of the previous one, “Financial Crisis in Lebanon”. Section 1 presents conditions that led to the depreciation of the Lebanese Lira (LL); section 2 analyses the fundamental causes of the crisis; section 3 discusses its consequences; section 4 concludes with recommended policies to contain the crisis.

- The road to the fall of the Lira

A fixed exchange rate is sustainable only if the productivity of the economy, and its consumption and trade patterns are compatible with that fixed exchange rate. Otherwise, the balance of payments (BOP) will continuously show a deficit, meaning that the outflows of foreign exchange (FX) funds, usually US $, exceed the inflows, and official FX reserves will continuously decline. It is not an easy task to maintain a fixed exchange rate in a small and open economy, such as Lebanon’s with its loose fiscal and monetary policies. Financial policies have obviously failed since the early 1990s, as confirmed by persistent large fiscal deficits and mounting government debt and by a monetary policy by the central bank, Banque du Liban (BDL), which is based on borrowing FX funds from local banks at unusually high interest rates. This has constrained economic activity and weakened the financial condition of banks, while eventually putting pressure on the exchange rate of the Lebanese Lira.

The monetary crisis is now unfolding in Lebanon. The Lebanese Lira has effectively started to depreciate in September 2019, several weeks before the popular uprising. Money changers began exchanging dollars at gradually higher rates. But Lebanese high officials remain in a state of denial, refusing to acknowledge the obvious market facts, so the “official” rate is still maintained but with few bank transactions at LL1,500-1,515/$. This means that, for the first time in Lebanon, there are two parallel foreign exchange markets, with money changers’ rates often in the wide range LL1,600-1,800, a depreciation rate of around 12%. Another first has been the recent restriction by banks of the transfer of $-funds abroad.

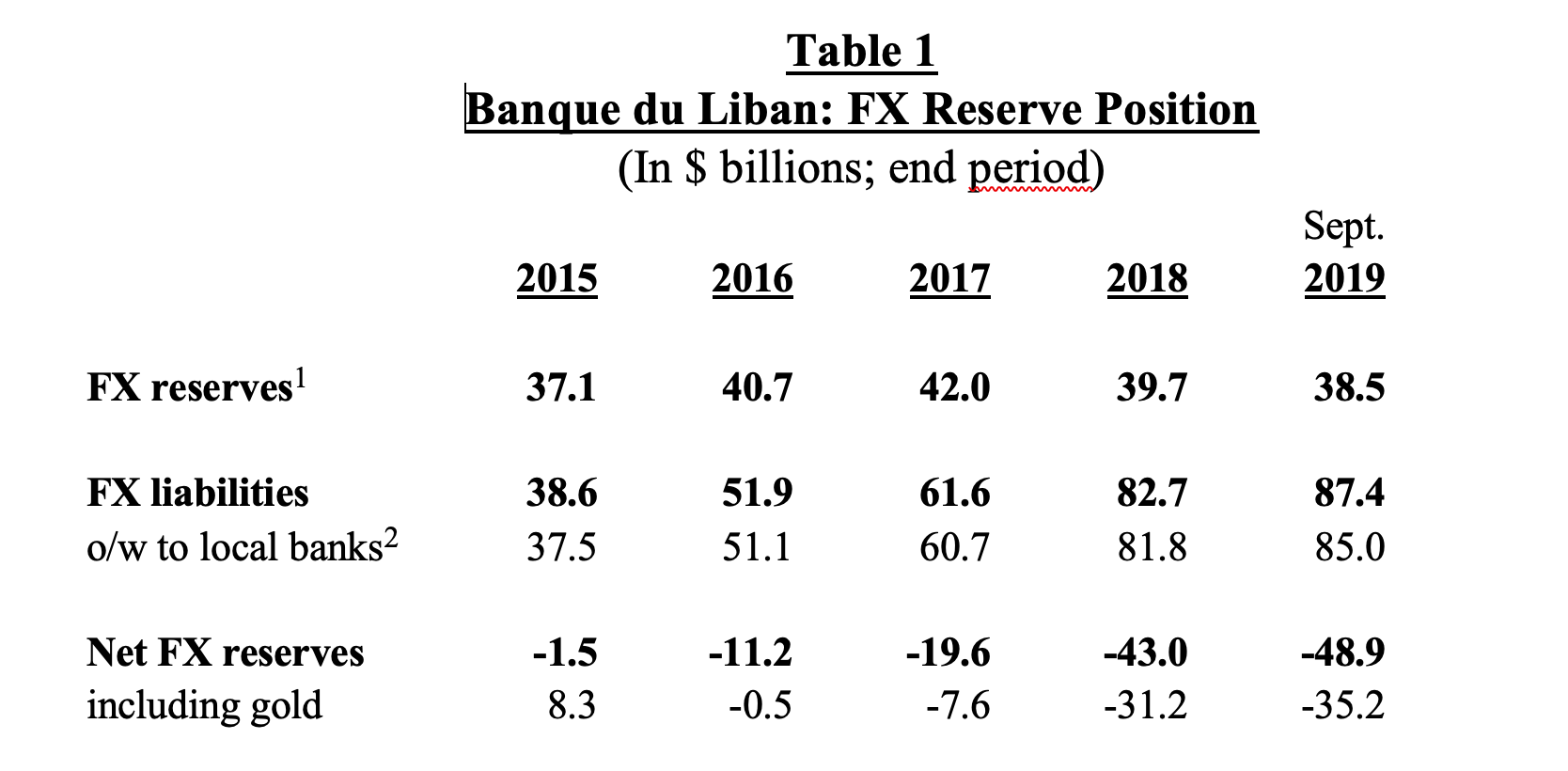

A few years back, some indicators were clearly announcing the mounting pressure on the Lira and on banks. BDL’s FX reserves were in continuous decline despite a steady borrowing by BDL from banks at ever higher interest rates. The result has been an alarmingly deteriorating situation of negative net FX reserves (see Table 1 below).

In addition, and importantly, the BOP was also in steady decline since 2011, indicating that more FX funds were continuously exiting Lebanon than entering it. This is unprecedented because, since independence and until 2010, Lebanon has not witnessed any period of more than two consecutive years of BOP deficit.

Source: BDL (www.bdl.gov.lb); Banking Control Commission (BCC) (2018).

Notes: 1- BDL reserves, excluding gold, are foreign-currency reserves (FX) deposited in foreign prime banks, plus short-term liquid investments, e.g. US Treasury Bills.

2- Data for 2015-17 are from BCC (2018), and the author’s estimates for 2018-19. For details on the estimates, see Gaspard (2017), p.9.

The pressure on the exchange rate then became manifest when a few months ago, as part of its so-called financial engineering”, BDL further raised interest rates on its $-borrowing from local banks to 11% for a term of three years. The gross yield to banks rose to 18% since BDL simultaneously pays the lending bank an additional bonus of 7%. It should be noted that this is happening at a time of falling and even negative international interest rates, as in Germany, Japan and Switzerland.

- Causes

In matters relating to financial risks, it has been customary in the media and official pronouncements in Lebanon to focus on the negative role of the budget deficit and government debt, while highlighting the positive role of BDL in countering such risks. It is, however, the contention of this writer that, while admitting the important responsibility of fiscal deficits and government debt in Lebanon’s deteriorating financial condition, an equal, if not greater, responsibility falls on BDL’s monetary policy.

The essence of BDL’s monetary policy has consisted in accumulating FX reserves to defend the fixed exchange rate, which is a logical and understandable policy in a fixed exchange-rate regime. However, especially with its announced “financial engineering” operations, BDL started borrowing large $ amounts from local banks at unnecessarily generous and gradually higher rates. The spreads, or margins paid by BDL over international reference rates such as the 6-month $-Libor, was more than 5% and now exceeds 9%! This is a remarkable cost to pay by a central bank instead of paying a margin of a fraction of 1%.

Moreover, none of BDL “financial engineering’s” declared objectives was achieved. On the contrary, its FX reserves have been in decline, the BOP has deteriorated since 2011, and the banks’ balance sheet has become vulnerable (more on the latter below).

BDL’s debt (the $-component only, excluding LL), which is estimated at more than $87 billion, is totally separate from government debt and now exceeds it. More seriously, BDL currently pays in $- interest cost on its $-bank borrowings an annual sum estimated at around $6 billion, far exceeding the budget’s interest cost. In other words, the main drain on the country’s FX reserves is originating from BDL and independently of the government budget.

Living for years beyond one’s means is at the heart of almost all currency depreciations, except perhaps in countries where the national currency is an international-reserve currency. And Lebanon has been living beyond its means for too long. The symptoms reside in the continuous deficits in the BOP and in the government budget.

Lebanese governments since the early 1990s have been implementing budgets, often without due legal process. However, the main problem in the fiscal deficits and rising government debt does not reside in the deficit and debt themselves but in the fact that these have been mostly financing current rather than capital expenditures. Of total budget expenditures of around $244 billion during 1993-2018, only about 8% went on capital expenditures, while more than two thirds were allocated about equally to interest on debt and wages and related benefits.

In parallel, the public sector has become bloated with political appointments, becoming a private domain for boosting political power and personal enrichment, with most public servants now owing their allegiance to politicians rather than to serving the public. Employment in the public sector amounted to 10% of total employment before 1975, and about 12% in the 1990s. But it is currently estimated to exceed 25%.

The root cause of Lebanon’s economic and financial hardships lies, however, in Lebanon’s loss of its sovereignty. This is the case of the powerful Lebanese party Hezbollah, whose leader publicly acknowledges that its ideological, political, and military existence is subservient to the Supreme Leader of Iran. It is impossible for any country to remain stable or to prosper if its major political and military decisions are controlled by a foreign or illegal power. The outcome of such an unusual situation can only be political instability and economic impoverishment.

The basic characteristic of any functioning State, let alone its prosperity, is its monopoly of the means of destruction and of the means of consumption, i.e. the military and money. The Lebanese state does not possess the monopoly of either. The loss of sovereignty has had a clear and lasting negative impact on many important aspects of economic life, including, in particular, domestic and foreign investments, aid and tourism.

- Consequences

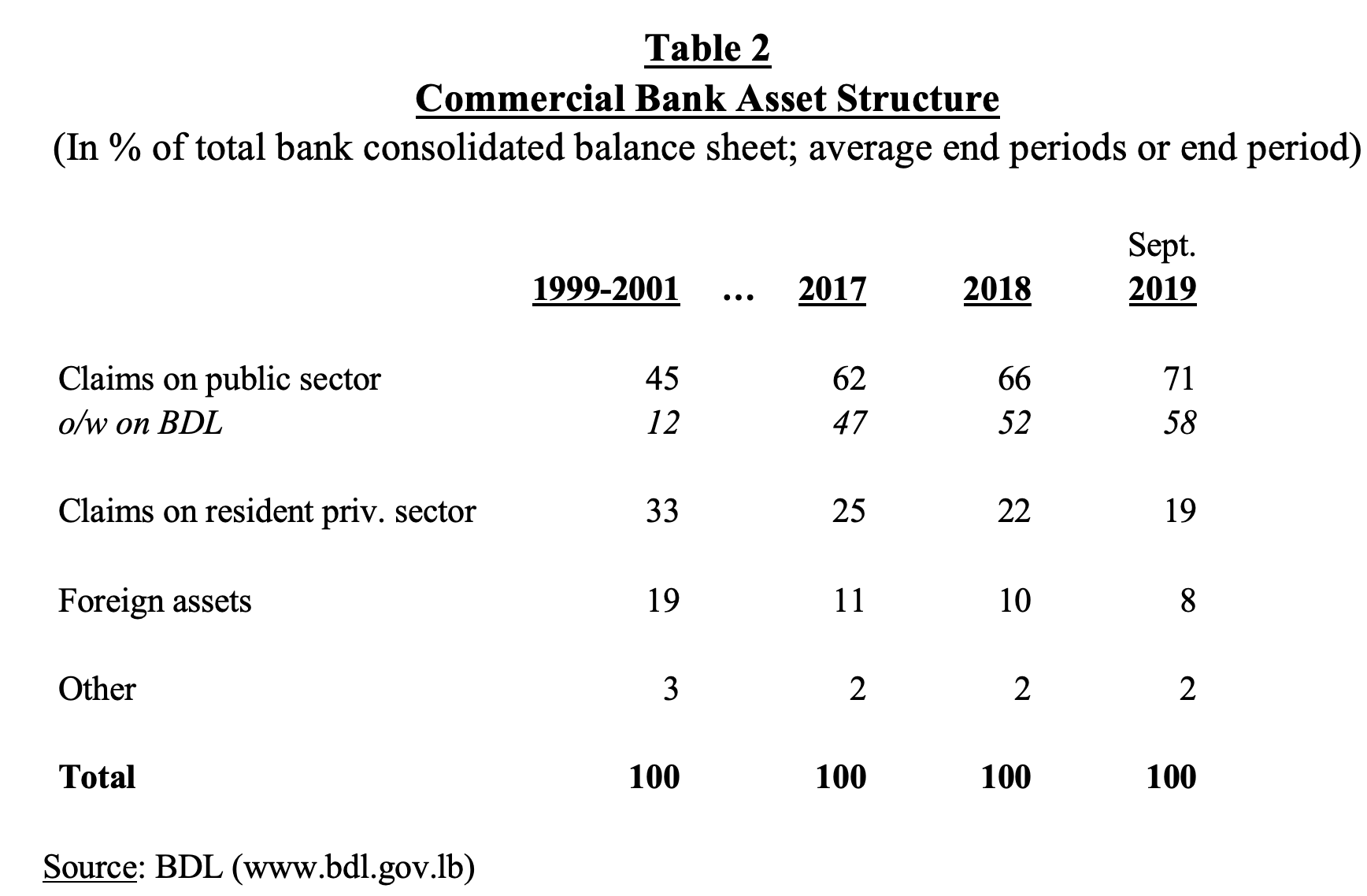

The most important impact of the financial crisis that has been building up in Lebanon for years has been on banks and economic activity. It has rendered fragile the financial condition of banks, and diverted bank funding from private enterprises to BDL. Table 2 below shows the relevant indicators.

It is in the nature of central banks to lend to commercial banks rather than borrow from them. But as Table 2 shows, 71% of commercial bank assets are credit to the public sector, of which a remarkable 58% are credit to BDL. A corresponding development has been a significant fall in banks’ foreign assets and liquidity, reflecting their shifting of their $-funds from prime correspondent banks abroad to lending to BDL. This is an unhealthy situation for banks by any standard, making them vulnerable to deterioration in the finances of the public sector, which is the most serious consequence of BDL’s “financial engineering”.

As a related development, banks have been reducing their lending to the private sector, in absolute and relative terms, in order to deposit the funds more profitably with BDL. From end 2017 to end September 2019, the consolidated balance sheet of commercial banks reveals that banks have reduced their total lending to the private sector, counting accumulated interest, by the equivalent of $12 billion. More seriously, as of early November 2019, banks have frozen the utilization of all credit lines and restricted the transfer of $-funds abroad, a first since independence. And banks, alongside BDL, share a major responsibility in this regard since for years they have been reducing their $-liquidity by shifting to BDL their $-reserves from correspondent banks, attracted by its very high interest rates compared to international rates.

The principal cause behind these developments is the high interest rates that BDL pays to borrow from banks. The BDL high rates have filtered down throughout the banking system. In an environment of real economic growth that is close to zero, while bank lending rates exceed 11%, real interest rates are above 6%. The result has been a surge in private enterprise failures and a further slowdown in economic activity.

But the major immediate and growing risk concerns the Lira exchange rate, which has already depreciated in the parallel market, though by a relatively small rate in the neighborhood of 12%. A further sustained depreciation would be devastating to most Lebanese whose incomes, pensions and often savings are in Lebanese Liras, with perilous economic, social and political repercussions. The officials, political and monetary, appear totally helpless in the face of these developments, with no sign of any existing policies or plans to counteract these risks.

The next section proposes specific and feasible measures to contain the developing crisis.

- Containing the crisis

It may be very difficult to arrest the depreciation of the Lira, but it is possible to contain the level of depreciation and thereby avoid serious economic, social and political developments. Two principles should govern the containment policies: A package approach to reforms, and enhancing governance, which essentially means enhancing accountability.

The following are specific policies that require a political consensus with the backing of the three Presidents, and early implementation to be publicly announced.

- Adopt a 3-year budget, 2020-22, with a gradually declining deficit to reach close to balance in the year 2022.

The corrective measures should include minimal increases in taxes and fees, and rely essentially on reducing much inflated or wasteful expenditures, and recovering unrealized budget revenues. For instance, total budget revenues from telecommunications, value-added tax and customs have abnormally remained throughout 2011-19 at around $5 billion, the same level as in 2009-2010, whereas GDP has increased by more than 35% during the period. “Normalizing” revenue collection in these items would bring in additional annual revenue of around $2 billion without any increase in taxes or fees. As for Electricité du Liban, which has substantially drained public finances for too long, a first step is to require a quick external audit.

Another fiscal measure of great importance is to reinstate the Single Treasury Account, which consists in bringing back the cash deposits of all public enterprises from banks to the Ministry of Finance’s account at BDL, which used to be the case in the past. These accounts at banks have averaged the equivalent of $4.7 billion in 2019. So the budget deficit can be internally financed from these accounts, even at a minimal interest rate, without having to borrow from the capital market. This, in association with the lower budget deficit, would result in a significant downward pressure on interest rates, with a corresponding significant saving in interest cost for at least a few years. Again, this can be achieved without any increase in taxes or fees.

- Question BDL’s “financial engineering” policy and its very high interest cost.

BDL’s costly monetary policy has resulted in mounting losses for many years since the borrowed dollars are deposited at much lower interest rates in international markets. BDL has not published profit&loss statements since 2002. Monetary policy should be questioned towards reducing the unnecessarily high interest rates paid by BDL, and thus bring down the whole structure of high interest rates that is constraining all debtors and economic activity. As part of the package of measures, a new structure of competitive interest rates, starting with BDL, is proposed in the Appendix below.

- All public enterprises should submit and publish their audited financial statements.

This is required by law. But most public enterprises do not publish or even submit to the Ministry of Finance their audited, or even unaudited, financial statements (balance sheet and profit&loss statements). The public enterprises that need to be mentioned in particular are: Banque du Liban (BDL), Electricité du Liban (EDL), Council of Development and Reconstruction (CDR), National Social Security Fund, Casino du Liban, Middle East Airlines (MEA), etc. The last two enterprises are in principle private companies, but they are largely owned and effectively controlled by BDL.

This seemingly simple “technical” recommendation can be instrumental in notably improving governance. The public availability of audited financial statements of public enterprises would provide various officials, but especially the public and civil society, with facts and an important tool to monitor and question the actual performance of official authorities. This is an essential aspect of the practice of democracy.

Lebanon’s public sector (Ministries and public enterprises) is in need of substantial review and reform though, above all, only a recovery of political sovereignty can constitute a first step on a process of genuine political and economic reforms. The recommended policies above aim in particular to contain the mounting currency crisis and a speedy and comprehensive implementation is essential. Any measures that are not in a similar vein would be merely noise.

Appendix

The structure of interest rates in Lebanon is very costly and unsustainable. In an environment of practically zero real economic growth, bank loan interest rates of more than 11% (and associated real interest rate of more than 6%) are literally punishing, as businesses are closing down and economic activity is diminishing, exacerbating an already difficult economic and financial situation.

Interest rates need to decrease significantly, as part of the package of reform measures that are proposed to contain the unfolding crisis. The following proposed competitive rates are mostly on $ funds, and in reference to the $ 6-month Libor, which is currently around 2%.

Reference 6-month Libor 2%

Bank $-deposits at BDL 21/8%-21/4%

Bank offered rate on $-deposits 2½%

Bank prime rate on $-loans 5% (2½%+2% overhead +½%)

Government LL 6-month TBs 3% approx.

Government $-Eurobonds Market

Toufic Gaspard

D.Phil. in Economics, Sussex University, U.K.

He has worked as Senior Economic Advisor to the Minister of Finance; Advisor at the International Monetary Fund in Washington, D.C.; Banker in New York, Brussels and Beirut; Director of Research at Banque du Liban; and Lecturer in Economics at the American University of Beirut and at Université St Joseph. More recently, he has done consultancy work for the EC and UNDP on various economic and social issues in Lebanon and the region.

He published in 2004 A Political Economy of Lebanon 1948-2002: The Limits of Laissez-faire, Brill Academic Publishers, Boston and Leiden. The book was also published in Arabic, in 2005 at Dar An-Nahar, Beirut.

References

Banque du Liban (BDL). Financial data, at http://www.bdl.gov.lb.

Banking Control Commission (BCC) (August 2018). Report on 2017 Operations, in Arabic, Unpublished.

Gaspard, Toufic (August 2017). Financial Crisis in Lebanon, Beirut: Maison du Futur and Konrad Adenauer Stiftung.

(2004). A Political Economy of Lebanon, 1948-2002: The Limits of Laissez-faire, Leiden and Boston: Brill Academic Publishers.

International Monetary Fund (IMF). Various reports on Lebanon, at http://www.imf.org.

Lebanon Ministry of Finance. Financial data at http://www.finance.gov.lb.